A modern approach to workplace design and build.

Have you ever considered leasing your entire workspace? What could that do for the future of your business?

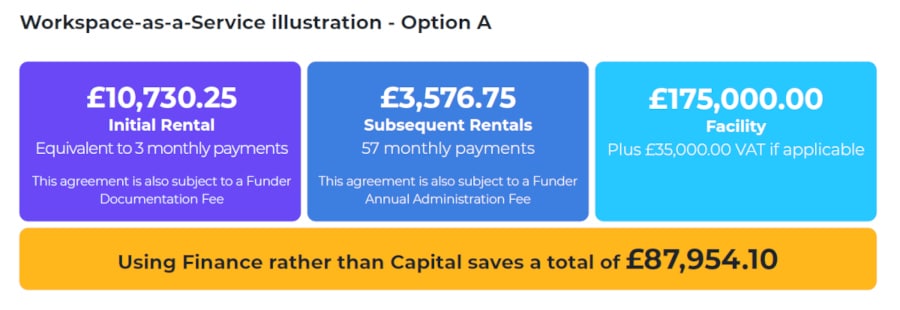

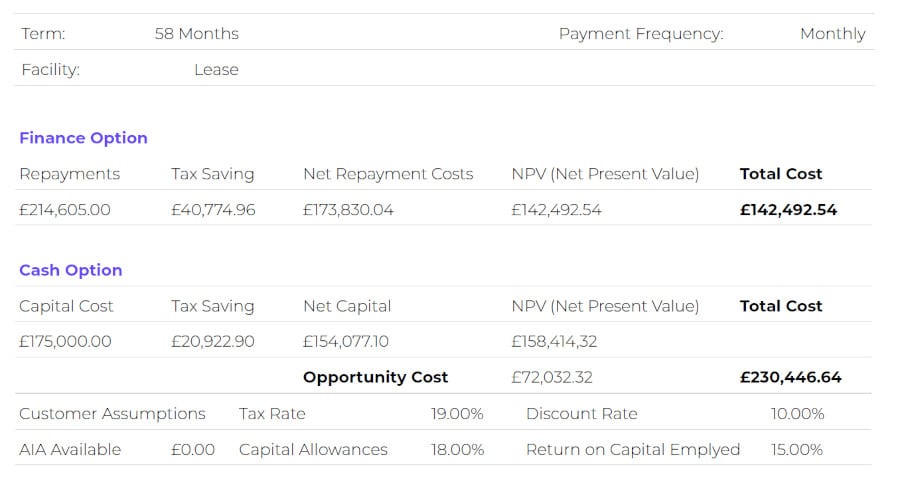

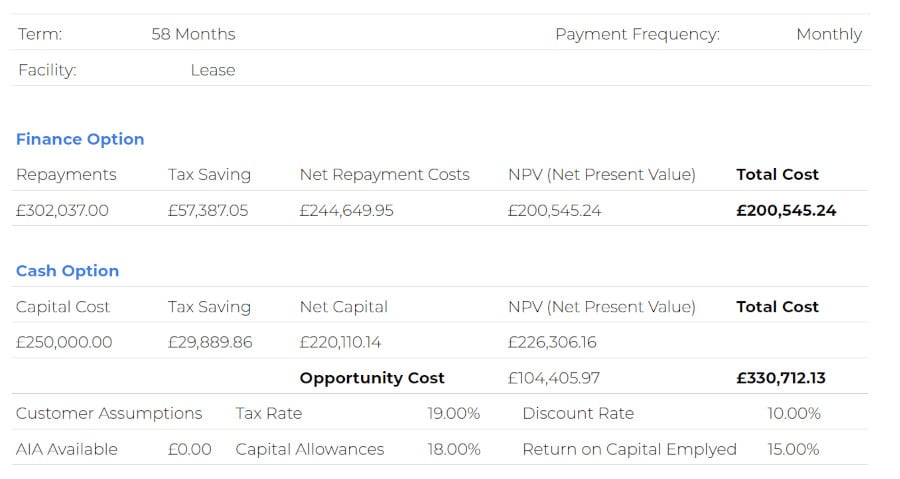

You’ll get rid of large, upfront capital expenditure and move to a model that prioritises your business’ stability and your employees wellbeing.

Cutting-edge design, future-proof facilities and tantalising technology will shape your workspace bringing with it all the productivity benefits and employee satisfaction that make your business more profitable.